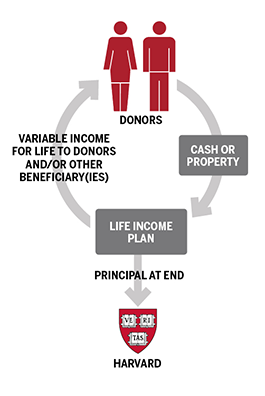

Life income plans enable you to make a substantial gift to the College, the Harvard Kenneth C. Griffin Graduate School of Arts and Sciences, or the Harvard John A. Paulson School of Engineering and Applied Sciences, and receive an income for life or a term of years. At the death of the last beneficiary or at the conclusion of the term, the gift is released to Harvard for the purpose you specify.

Popular Life Income Arrangements

Charitable Remainder Unitrusts

Charitable Gift Annuities

Pooled Income Funds

These arrangements provide a range of benefits, including:

- Income to one or two beneficiaries, for life or a term of years

- An immediate charitable income tax deduction

- Capital gains tax avoidance on a gift of appreciated property

- Investment diversification

- Professional management and investment diversification through Harvard Management Company or TIAA Kaspick, with no separate fee

- Estate tax savings

- The ability to make a significant gift to Harvard

Charitable Remainder Unitrusts

A charitable remainder unitrust is a separate tax-exempt account into which you transfer your gift. Harvard will serve as trustee, direct the investment of the trust assets, and oversee all legal, accounting and administrative matters.

Harvard can pay you a percentage of the unitrust’s value as income, typically 5 percent. As the value of the unitrust changes, so too does your income.

Alternatively, the trustee can pay you a fixed payment each year, based on a percentage, typically 5 percent, of the funding amount of the unitrust.

Benefits

- Quarterly income for life; support for your spouse or other beneficiaries

- Potential for growth of income over time

- Investment diversification

- No capital gains tax on gifts of appreciated assets

- Charitable income tax deduction

- Gift and estate tax savings

- Investment management services provided by either Harvard Management Company (the Endowment Strategy) or TIAA Kaspick (the Tax Efficient Strategies) with no separate management fee

- Significant future support for Harvard’s research and teaching

Unitrust Investment Options

Charitable remainder unitrusts can be invested by Harvard Management Company alongside the Harvard endowment or by TIAA Kaspick in a manner geared to pay income taxed at lower rates. Please see this overview of the investment strategies.

Guidelines

- Gift minimums are $150,000 for unitrusts with beneficiaries age 50 and older, and $250,000 for unitrusts with beneficiaries 45–49 years old.

- You can donate a wide variety of assets to a unitrust—cash, publicly traded securities, closely held stock, real estate, art, antiques, collections, or intangible assets such as royalties.

Request a Personal Gift Illustration

Please contact us at 617-496-3205 or use our electronic form.

Charitable Gift Annuity and Deferred Gift Annuity

Charitable and Deferred gift annuities are simple contracts between you and Harvard that offer a tax-advantaged way to provide for income during retirement. In the future, your gift provides support for Harvard’s mission.

You can begin to receive income right away, or defer it to a predetermined future date one year or more after the gift. You also can decide when the income payments begin within a future time frame, determined when you make your gift. In any case, your income is taxed at a favorable blended rate.

Benefits

- Steady, guaranteed lifetime payments, backed by the assets of the University

- Charitable income tax deduction

- Avoidance of capital gains tax

- Savings on gift and estate taxes

- Future support for Harvard

Guidelines

- Minimum gift of $25,000

- Payments can begin at age 40 or later

- Can be funded with cash, securities, or other property

Harvard University Gift Annuity Rates

Income rates are based on your age or the age(s) of your beneficiary(ies) when quarterly payments begin.

Request a Personal Gift Illustration

Please contact us at 617-496-3205 or use our electronic form.

Pooled Income Funds

Pooled income funds consist of gifts from multiple donors that are combined into a trust invested for Harvard by TIAA Kaspick. Pooled income funds offer you income and tax benefits and ultimately support the work of the University.

A pooled income fund gift entitles you and your beneficiary to your proportional share of the quarterly income of the fund for life. On the death of the last income beneficiary, the principal of your gift will be used by Harvard.

Benefits

- Quarterly income for life

- Support for your spouse or other beneficiaries

- Charitable income tax deduction

- Avoidance of capital gains tax

- Gift and estate tax savings

- Future support for Harvard

Harvard Pooled Income Funds

- Harvard Life Return Fund: Seeks to earn a sustained high rate of income over the long term and is invested primarily in fixed-income mutual funds.

- Harvard Growth Fund: Generates modest income and seeks long-term growth of principal. The fund invests primarily in domestic equity securities.

- Harvard Balanced Fund: Combines the strategies of the other two funds, and offers a moderate level of current income as well as opportunities for long-term growth of both principal and income.

Guidelines

- A gift to a pooled income fund can be funded with cash or marketable securities.

- Each of the funds requires a minimum initial gift of $25,000.

- The minimum age for beneficiaries is 50 years old for the Life Return Fund, 25 for the Growth Fund, and 40 for the Balanced Fund.

Request a Personal Gift Illustration

Please contact us at 617-496-3205 or use our electronic form.