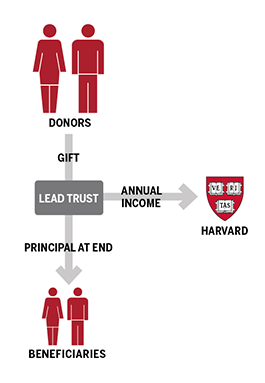

With a charitable lead trust, you can make annual gifts to support an area of interest to you at Harvard for a term of years, typically between 10 and 20.

At the same time, this intergenerational wealth-transfer tool enables you to provide for your heirs, while sharply reducing gift and estate taxes. When the term ends, trust assets are transferred typically to your children or grandchildren.

The annual payments to Harvard can be based on a fixed schedule, determined when you fund your gift, or can be based on a fixed percentage of the value of the trust assets and fluctuate from year to year.

The donor may establish the trust with either Harvard or their preferred trust company.

Benefits

- Federal gift and estate-tax deductions for the value of annual trust payments to Harvard may enable you to transfer to your heirs a larger estate after tax than would otherwise be possible.

- Any appreciation in the assets during the term of the trust, while subject to capital gains tax, is not subject to gift or estate tax at the trust’s termination.

- Harvard's planned giving partner, TIAA Kaspick, can invest and administer your trust, with no separate management fee.

Guidelines

- A minimum of $1 million is needed to establish a lead trust.

- Cash and high-basis marketable securities are the best assets to fund a lead trust.

Diversified Investment Strategy

Harvard lead trusts are invested in a diversified portfolio designed to provide exposure to a wide variety of domestic, foreign, and emerging markets.

Request a Personal Gift Illustration

Please contact us at 617-496-3205 or use our electronic form.